Contents:

This is slightly different from the way double-entry functions. In double-entry, companies record income the moment they earn it. Further, you would be able to quickly tell the company’s financial health from the financial statements with help of the best financial management software.

Start with your existing cash balance for a given period, then add the income you receive and subtract your expenses. After you factor in all these transactions, at the end of the given period, you calculate the cash balance you are left with. Single-entry bookkeeping is probably only going to work for you if your business is very small and simple, with a low volume of activity. It is actually similar to keeping your own personal checkbook.

Ideal for Service-Based Businesses

You keep a record of transactions like cash, tax-deductible expenses, and taxable income when you use single-entry bookkeeping. A P&L displays how profitable a company is within a certain period of time. It’s a key document to understand your company’s financial health and see where you can or need to cut costs. Single-entry bookkeeping is focused on producing this report, which may give small business owners all the tools they need to monitor their business finances themselves.

Assets increase by $1,000 and liabilities increase by $1,000. A bachelor’s degree in accounting can provide you with the necessary skills to start an entry-level role as an accountant. So this amount is debited to your account and raises the account balance to $4500. On the second day of the week you pay your rent, which is $1000. Since this is an expense, you subtract this amount from your cash balance. Let’s assume you have a $5000 cash balance at the beginning of the first week in June.

With a double-entry system, bookkeepers can notice and correct errors quickly. All transactions are recorded on two accounts -the debits and credits must balance. Therefore, there is minimal to zero chance of mistakes, misappropriation, and fraud. With a single-entry bookkeeping system, you will record transactions like taxable income, cash, and tax-deductible expenses. Each transaction included in the single column can either be negative or positive.

Hard to Track Assets and Liabilities

The cash disbursement journal can be analyzed and compared by a simple glance. As there are two entries of all transactions, it is highly unlikely that a mistake or error be made. It increases accuracy, and the merchants can maintain a good financial record. There are several reasons why double-entry might be considered superior. If you keep track of your expenses and income separately, you can’t make mistakes in the numbers. A Double-entry system is better because it prevents you from using the same account for two things.

Triple-Entry Bookkeeping: How Satoshi Nakamoto Solved the … – Bitcoin News

Triple-Entry Bookkeeping: How Satoshi Nakamoto Solved the ….

Posted: Sun, 02 Aug 2020 07:00:00 GMT [source]

These include single-entry bookkeeping, double-entry bookkeeping, computerized bookkeeping systems, and virtual bookkeepers. In fact, a double-entry bookkeeping system is essential to any company with more than one employee or that has inventory, debts, or several accounts. Public companies must use the double-entry bookkeeping system and follow any rules and methods outlined by GAAP or IFRS . Accounting software has become advanced and can make bookkeeping and accounting processes much easier. The software can reconcile data from different accounts and automate accounting processes. A person of little accounting knowledge can maintain records as per single entry system, but due to some shortcomings in this system, double entry system has been evolved.

Single- Vs. Double-Entry Bookkeeping

Single entry is the most simple bookkeeping method and involves making only one entry for every transaction. Since there is only one entry, there is usually no record of liabilities or assets. The records will mainly consist of the cash flowing into and out of the business. When you generate a balance sheet in double-entry bookkeeping, your liabilities and equity (net worth or “capital”) must equal assets. For businesses in the United States, the Financial Accounting Standards Board , is a non-governmental body. They decide on the generally accepted accounting principles , which are the official rules and methods for double-entry bookkeeping.

You’ll learn bookkeeping basics like double-entry accounting, along with accounting for assets and financial statement analysis. With courses like these under your belt, you’re well on your way to becoming a successful accountant. Double-entry accounting is a system where each transaction is recorded in at least two accounts. This method provides a more complete picture of a business’s finances, and is typically used by larger businesses. Due to two-fold effect, the system possesses completeness, accuracy as well as it matches with the Generally Accepted Accounting Principles .

Transactions are recorded in a “cash book”—a journal with columns that organize transaction details like date, description, and whether it’s an expense or income. Single-entry bookkeeping doesn’t allow for this type of verification. Although single-entry bookkeeping is simpler, it’s not as reliable as double-entry and isn’t a suitable accounting method for medium to large businesses. The accounting system of double entry accounting, often known as double entry bookkeeping, mandates that every company transaction or event be documented in at least two accounts. If our bagel shop uses single-entry accounting, we record the expense of buying flour and salt separately from recording the revenue of a sold bagel. While this is a feasible option for a small business, one thing to keep in mind is that single-entry accounting can be error-prone.

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed. Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed. When you pay for the domain, your advertising expense increases by $20, and your cash decreases by $20. For example, an e-commerce company buys $1,000 worth of inventory on credit.

What is the Difference Between Single Entry and Double Entry Bookkeeping?

For a sole proprietorship, single-entry accounting can be sufficient, but if you expect your business to keep growing, it’s a good idea to master double-entry accounting now. With the help of accounting software, double-entry accounting becomes even simpler. At any point in time, an accountant can produce a trial balance, which is a listing of each account and its current balance. The total debits and credits on the trial balance will be equal to one another. Accountants frequently review the trial balance to verify that they posted journal entries correctly, as well as to correct any errors. The term “bookkeeping” refers to a business’s record-keeping process.

The Long and Winding Road to Financial Reporting Standards – The Harvard Law School Forum on Corporate Governance

The Long and Winding Road to Financial Reporting Standards.

Posted: Wed, 20 Jul 2022 07:00:00 GMT [source]

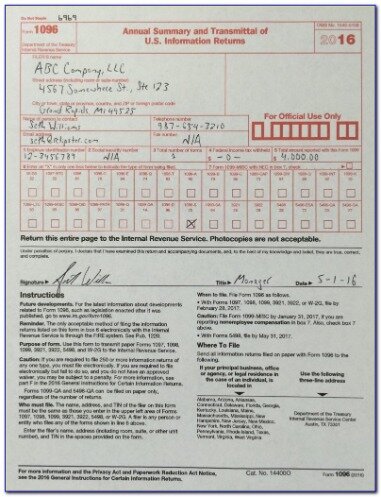

She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS. In order to choose the best financial process for your business, it’s important to understand the different types of bookkeeping systems. An efficient bookkeeping system is crucial to the success of a business since it measures the financial performance of the business. It also provides the data needed to make the most effective strategic decisions and serves as a goalpost for revenue and income goals.

These additional accounts are assets, equities, and liabilities. When it comes to approximations of profit or less, this type of system falls short. This is because the accounting data available to it is limited. Thus, with only such data, it will not be able to tell you your overall profit or loss. You record your business transfers in a single system in just one account. Therefore, this account reflects all the changes that take place.

Then, the double-entry reduces the amount the business now owes to the creditor account as it has received the amount of the credit the business is extending. No information is available on sales, purchases, and cash and bank balances; only personal accounts are considered. Therefore, this method cannot be used practically since it does not provide cash or daily transaction information. Contrary to double-entry transactions, which demand expertise, single-entry transactions are straightforward and don’t require in-depth account knowledge. Single-entry systems keep incomplete records, whereas double-entry systems capture both sides of the record.

FreshBooks vs QuickBooks Online: Which Accounting Solution Is Best for Your Business? – TechRepublic

FreshBooks vs QuickBooks Online: Which Accounting Solution Is Best for Your Business?.

Posted: Thu, 13 Oct 2022 22:30:04 GMT [source]

Every business transaction or accounting entry has to be recorded in at least two accounts in the books. For example, a copywriter buys a new laptop computer for her business for $1,000. She credits her technology expense account for $1,000 and debits her cash account for $1,000. This is because her technology expense assets are now worth $1000 more and she has $1000 less in cash. In single entry system, incomplete records are maintained while in double entry system complete recording of transactions is there.

On the other hand, the single-entry system doesn’t follow this rule; hence mistakes can be compounded without noticing. Single entry bookkeeping is an accounting system that features one entry for every transaction. It is an excellent choice for small, uncomplicated businesses with minimal activity. The single entry system is an incomplete accounting system used by small business owners with a modest number of transactions. When you employ single-entry accounting, you keep track of transactions such as cash, tax-deductible expenditures, and taxable revenue.

What is the difference between Single-Entry Accounting and Double-Entry Accounting?

As per Generally Accepted Accounting Principles , all big organisations use double entry systems instead of single-entry systems to keep track of its finance in all companies. A double-entry bookkeeping system involves recording financial transactions in two accounts- debit and credit accounts. It relies on the rule of duality; every transaction affects both accounts simultaneously. One account is therefore credited while the other is debited. At the end of the financial period, the total credits must equal total debits. Single-entry bookkeeping is used by businesses that use the cash-basis accounting method since cash sales and expenses are tracked for the business at the time they are incurred.

- However, this won’t be an issue if you’re in a creative service-based business with few expenses related to producing your work .

- This is because the accounting data available to it is limited.

- As mentioned in the previous point, limited accounts are opened, and the books are scarce, expenses to maintain these accounts are also limited.

- Tasks such as preparing a budget, checking for tax compliance, and evaluating business performances; can help your decision-making.

- This is unlike a double-entry system with two lines for each transaction.

- With a single-entry bookkeeping system, you will record transactions like taxable income, cash, and tax-deductible expenses.

Almost all the countries of the world have adopted double entry system for maintaining accounting records. As an example, let’s say you run Bagel.co, a company that allows users to buy, sell, and trade bagels. Bagel.co moves funds between accounts that they operate on behalf of their customers. Customers 1-3 buy and sell bagels to each other, and cash out the balances of their accounts on your platform to external banks. Below is an example double-entry ledger of their transactions. Bookkeeping is an important activity for maintaining accurate financial records.

- In addition, a single-entry system involves recording a few transactions.

- Small business owners need to understand this topic to ensure their company’s financial status and security are protected for the long term.

- With our flexible, powerful, cloud-based accounting software solution, you can generate detailed accounting records in whichever bookkeeping system works best for you.

- It is the oldest method of maintaining financial records in which an entry is made for every financial transaction.

- No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation.

Discounts, which are entered into personal accounts, are not kept in a separate record. In addition, there is some limited information about a few key elements of expense, such as labour, rent, and rates. In reality, this is the way that is most commonly used to replace the double-entry system.